ETH Price Prediction: Bullish Trends and Long-Term Forecasts (2025-2040)

#ETH

- Technical Strength: ETH trades above key moving averages with bullish MACD divergence.

- Market Sentiment: ETF hype and DeFi revival offset short-term scam risks.

- Long-Term Value: Treasury adoption and scalability drive multi-decade upside.

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

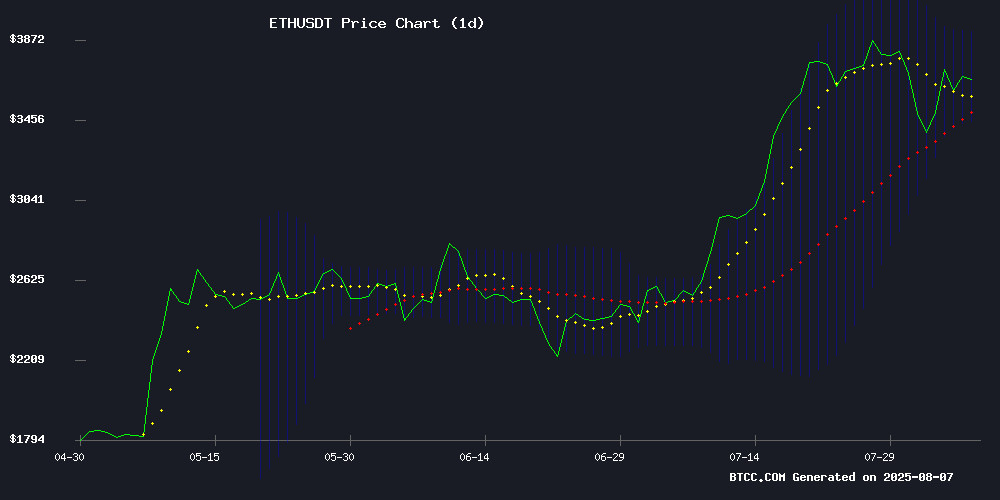

According to BTCC financial analyst Olivia, ethereum (ETH) is currently trading at $3,819.63, above its 20-day moving average (MA) of $3,692.33, indicating a bullish trend. The MACD histogram shows a positive divergence at 153.7511, suggesting upward momentum. Additionally, ETH's price is hovering near the upper Bollinger Band ($3,933.23), which may signal potential resistance or further upside if breached.

Ethereum Market Sentiment: ETF Optimism and DeFi Growth

BTCC financial analyst Olivia highlights that Ethereum's recent surge past $3,500 is fueled by ETF Optimism and a resurgence in DeFi activity. News of SharpLink Gaming's $200M fundraise targeting Ethereum's treasury and Aave's $60B deposit milestone underscores institutional interest. However, scam ads and ETF outflows pose short-term risks, while long-term fundamentals remain strong.

Factors Influencing ETH’s Price

Ethereum Surges Past $3,500 Amid ETF Optimism and DeFi Revival

Ethereum (ETH) breached the $3,500 threshold this week, fueled by a wave of institutional buying and growing anticipation of spot ETF approvals by Q4 2025. Bloomberg analysts peg the likelihood of SEC approval at 70%, a move that could unlock billions in institutional capital. The rally coincides with resurgent activity in Ethereum’s DeFi ecosystem, where protocols like Aave and Uniswap now hold over $15 billion in total value locked.

BlackRock and Fidelity have emerged as frontrunners in the race for Ethereum ETF filings, mirroring the path blazed by Bitcoin ETFs earlier this year. Network upgrades have further bolstered ETH’s appeal—post-Dencun, transaction speeds improved while gas fees reached their most efficient levels in years. Yet retail investors appear divided: while some chase momentum, others are turning to cloud mining platforms like AIXA Miner to accumulate ETH without direct market exposure.

SharpLink Gaming Targets $2B Ethereum Treasury with $200M Fundraise

SharpLink Gaming has secured $200 million in a registered direct offering, led by four global institutional investors. The Nasdaq-listed company plans to channel these funds into expanding its Ethereum treasury, aiming for a total valuation exceeding $2 billion. With 521,939 ETH already under management, SharpLink now ranks as the second-largest corporate holder of Ethereum.

The offering, priced at $19.50 per share, is expected to close by August 8, 2025, subject to regulatory approvals. SharpLink's strategy revolves around accumulating, staking, and growing its ETH per share to solidify its long-term position in the market. This move underscores the company's ambition to become a dominant force in corporate Ethereum adoption.

Aave Users Targeted by Scam Ads Following $60B Deposit Milestone

Decentralized finance protocol Aave faced a phishing attack just days after achieving a historic $60 billion in net deposits across 14 blockchains. The platform's deposits have surged over 200% year-over-year, cementing its position as the first DeFi project to reach this valuation tier.

Malicious actors exploited Google Ads to promote fake Aave investment portals, with security firm PeckShight identifying aaxe[.]co[.]com as a primary phishing domain. The scam sites employed wallet-draining techniques through fraudulent transaction signatures, resulting in irreversible fund losses for connected wallets.

The timing coincides with Aave's accelerating institutional adoption, as evidenced by its tripled deposit volume since August 2024. Security analysts warn that such high-profile milestones increasingly attract sophisticated social engineering campaigns targeting crypto users.

Nasdaq-Listed Cosmos Health Plans $300 Million ETH Treasury

Cosmos Health Inc., a Nasdaq-listed healthcare firm, has secured a $300 million facility to build an Ethereum-based treasury strategy. The company will issue senior secured convertible promissory notes to fund digital asset reserves, with at least 72.5% of each tranche allocated to ETH accumulation. The remaining capital will support working capital and business operations.

The move underscores Cosmos Health's broader digital transformation, integrating blockchain for supply chain tracking and wellness programs. Acquired ETH will be custodied and staked via BitGo Trust Company, leveraging institutional-grade infrastructure. CEO Grigoris Siokas called the financing a strategic milestone, offering shareholders direct exposure to Ethereum's global adoption.

This rare foray into crypto by a healthcare company highlights growing institutional interest in digital assets. The facility, backed by an unnamed institutional investor and managed by Curvature Securities, also aims to accelerate product development and expand U.S. manufacturing capabilities.

Ethereum’s Wealth Inequality Shapes Market Dynamics

Ethereum's network exhibits stark wealth inequality, with over 74% of its total supply concentrated in the top 100 addresses as of July 2025. This imbalance mirrors trends seen in other digital currencies, raising concerns about market trust and fairness.

Market analysts warn such concentration could distort Ethereum's long-term ecosystem health. Large holders may wield outsized influence over price movements and liquidity. "A substantial portion of the total supply is concentrated in a very limited number of Ethereum addresses," notes analyst Kevin Wang.

The debate continues whether this wealth distribution will fundamentally determine Ethereum's market dynamics. Some experts suggest decentralized finance applications could gradually redistribute influence, while others foresee persistent centralization risks.

SharpLink Gaming Secures $200 Million to Expand Ethereum Treasury

SharpLink Gaming, a publicly traded company, has raised $200 million in a private placement led by four global institutional investors. The funds will be directed toward expanding its Ethereum (ETH) holdings, with the treasury expected to exceed $2 billion once fully deployed.

The firm has already added over 18,000 ETH to its portfolio, bringing its total holdings to nearly 500,000 ETH. This move underscores growing institutional confidence in Ethereum as a strategic reserve asset.

ETH ETFs See Record Outflows as WeWake's No-Wallet Crypto Gains Traction

Ethereum exchange-traded funds are facing their steepest reversal yet, with spot ETH ETFs recording $465 million in daily outflows on August 4. BlackRock's iShares ETH Trust led the exodus with $375 million withdrawn, followed by Fidelity's ETH Fund and Grayscale's ETH Trust. This marks a sharp contrast to July's bullish momentum, when these products attracted $5.4 billion in net inflows over 20 consecutive trading days.

While institutional investors retreat from ETH ETFs, attention is shifting toward innovative blockchain projects like WeWake Finance. The platform's ongoing presale is gaining momentum with its wallet-free accessibility approach, highlighting a growing divide between traditional crypto investment vehicles and next-generation user-centric solutions.

Fake Crypto Trading Bot Scam on YouTube Steals Over 256 ETH

Cybersecurity firm SentinelLABS has uncovered a sophisticated crypto fraud operation exploiting dormant YouTube accounts to promote fake trading bots. The scam, active since January 2024, involves compromised smart contracts designed to drain victims' wallets.

Senior threat researcher Alex Delamottea revealed scammers post tutorial videos instructing users to deploy malicious contracts via Remix. These contracts grant attackers hidden access to victims' funds, with spoofed wallet addresses masking the theft.

The scheme has siphoned over 256 ETH ($939,000) by tricking users into sending 0.5 ETH deposits under false pretenses of gas fees. Three identified scam wallets received 7.59 ETH, 4.19 ETH, and 244.9 ETH respectively, with many more addresses involved.

Fraudsters repurpose old YouTube channels with crypto-related content, using AI-generated videos to lend credibility. The operation's scale remains unclear due to wallet reuse across multiple scams.

Consensys-Backed Etherex Launches REX Token on Linea with Anti-Bot Fee Mechanism

Etherex, a decentralized exchange on Consensys' Linea blockchain, has launched its REX token featuring innovative decaying fee mechanics. The 50% initial purchase fee decays exponentially over 30 minutes, a design targeting bot prevention while establishing fair market conditions.

With $213 million market capitalization at launch, REX introduces liquid emissions and zero team allocations - an experiment in decentralized token distribution. Joseph Lubin's endorsement highlights the token's potential to coordinate liquidity more efficiently across Linea's growing DeFi ecosystem.

The token serves as the foundation for Etherex's auto-compounding yield architecture, positioning itself as a potential primitive for next-generation DeFi infrastructure. This launch follows increasing institutional interest in Layer 2 solutions as Ethereum scaling narratives gain momentum.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on technical and sentiment analysis, BTCC's Olivia projects the following ETH price ranges:

| Year | Conservative Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|

| 2025 | $4,500-$5,000 | $6,000+ | ETF approvals, DeFi adoption |

| 2030 | $10,000-$15,000 | $20,000+ | Institutional treasury allocations |

| 2035 | $25,000-$40,000 | $50,000+ | Global smart contract dominance |

| 2040 | $50,000-$75,000 | $100,000+ | ETH as reserve asset |

Forecasts assume sustained network upgrades and regulatory clarity. Volatility risks remain.